Digital is changing the way we shop and in return, it is changing the way retailers respond to our demands. Like many industries, retailers are experiencing major disruption from digital: new technology is changing customer behaviour, offering more choices and empowering the consumer with information when they want, where they want, and how they want it.

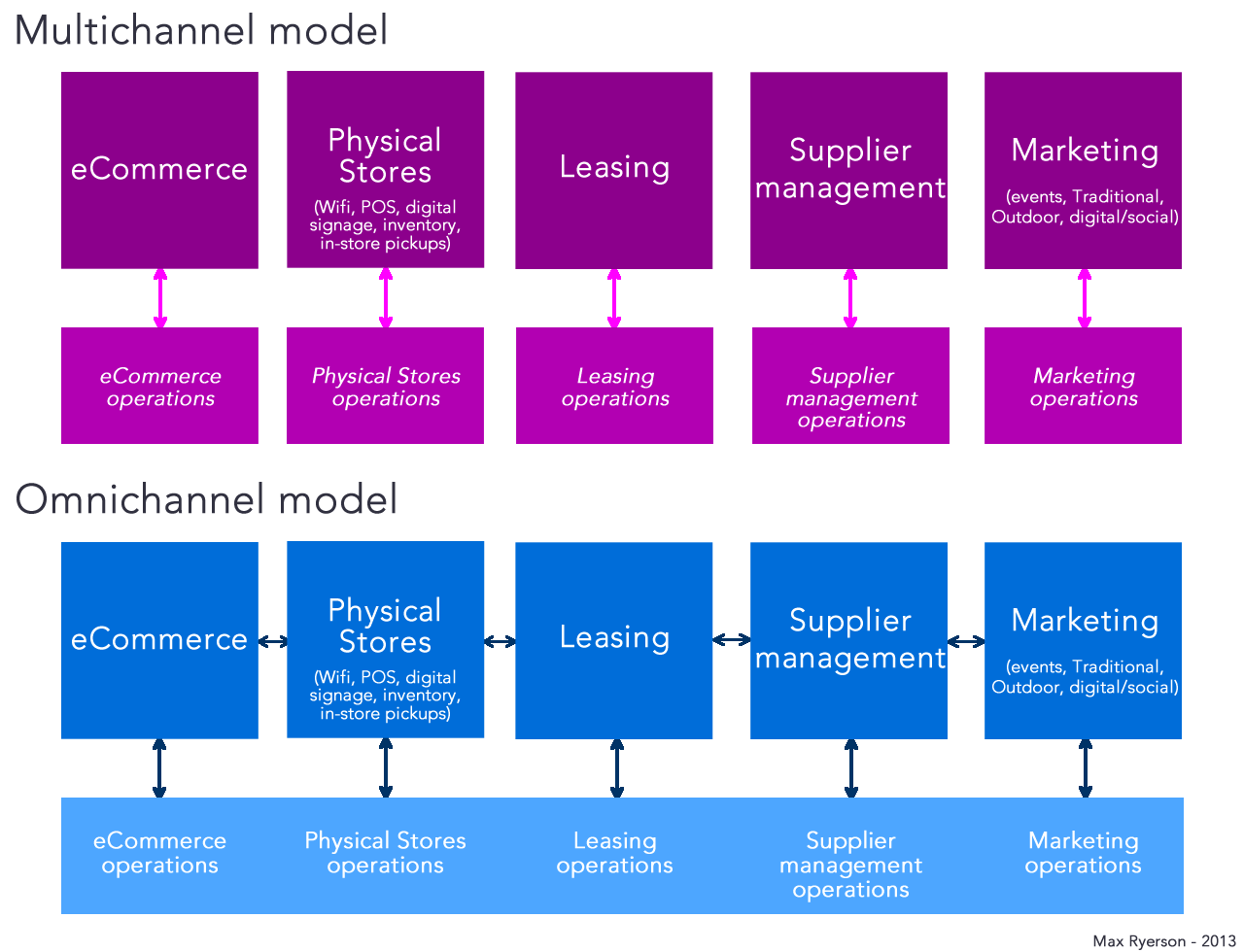

Most executives understand multichannel – undertaking activities in several channels such as online (eCommerce), a network of stores, social media, marketing events, and traditional sales initiatives – all tied by a back-end operations unit. However, multichannel implies that the operations being undertaken in each channel are siloed.

In an omnichannel world, there are no silos – each activity in each channel is not only seamless from an experience point of view by virtue of the correct branding strategy implementation but is interconnected. All information is shared across all channels.

This is where many stumble in the nuance between both but has a huge impact on the way a business operates. It requires considerable shifts in managerial mindset, financial and human resources, investment, and staff learning and development.

The debate around whether digitisation and omnichannel works or not

And numerous case studies have shown that one channel won’t necessarily cannibalize the other. Retailers who have adopted an omnichannel approach to their business and appropriately invested in digital technology are seeing either level revenues or growth in their overall revenue. Some examples include Macy’s, Burberry, Westpac, and CommBank.

Macy’s for example now tracks online behaviour of its site visitors, promotes the download of its app on TV, has tagged (using QR codes) products inside the store and made them scannable using the app (and they’re tracking this too), and have transformed 500 of their stores into mini-distribution centres for online orders.

Another example: in March 2013, Westpac released an Australian Financial Services Market Update on the digitisation of their retail branch customer experience and how they’ve leveraged mobile in their retail environments.

Their digitisation had a major impact on their branch and channel design, technology and processes, and people’s roles, mix and capabilities. Their efforts resulted in more inviting retail environments with open and flexible branch layouts, 25 per cent smaller branch footprints with a larger front of house area (i.e. where sales are made), 24/7 self serve lobby convenience for their clients, enhanced digital marketing, in-branch mobile technology deployment.

This saw incredible gains in efficiency including a 20 per cent decrease in property and ATM lease costs, 40% reduction in paper usage, and in some case net customer growth up by 40 per cent.

According to the US Census Bureau, US online retail sales accounted for just over 13 per cent of total retail sales in 2012 (excluding groceries, fuel, and automobiles). In Australia, NAB’s Online Retail Sales Index shows online retail sales represent 6.3 per cent of total retail sales.

So bricks and mortar are still important but bricks and mortar stores will change significantly from what we experience today. Furthermore, as retailers are disrupted by market forces their transformation will impact other businesses who will need to adapt as well. It will see the birth of new businesses and the slow death of those who don’t change.

Online retailer Amazon is driving six times more online sales than its closest competitor.

Retailers are now rushing to engage with their customers on the Web, mobile, and social media but they’re forgetting one thing: in-store customer service. It’s not about the technology it’s about how you use it to satisfy your customers’ needs and create an emotional connection to convert them to consume.

“AMAZON IS DRIVING 6X MORE ONLINE SALES THAN ITS CLOSEST COMPETITOR.”

Looking at Apple, it’s bricks and mortar retail success is about the in-store customer experience. Layout plays a part, design plays a part, technology plays a part, but what nails the success and is the greatest differentiator is the staff that makes the customer experience so valuable. Each staff member is highly knowledgeable about the products and services being sold.

It’s a simple concept that seems other retailers are simply not investing in.

The fear by traditional retailers of the general assumption that online retailers would steal their market share at a rapid rate is

The resulting disappearance of companies – retailers or non-retailers – is a product of their inefficiencies in light of market forces… not solely the success of online retailers.

What so many retailers have lost over the years in their determination to deal with global price pressures is customer service and what consumers crave: experience.

You don’t have to look far to witness this: department stores are the stereotypical example of this issue. Human being

Ultimately retailers who embrace both a digitally enabled omnichannel approach and a customer-centric retail experience will undoubtedly succeed and sustain longevity.

One of the main market forces driving such structural shifts in retail is customer behaviour and this behaviour has changed due to digital technology empowering shoppers by giving them access to more choice (i.e. more competition) and real-time information on products, brands, services regardless of geographical location.

TODAY’S CONSUMER BEHAVIOR

Traditional retailers who are not investing in training their staff to be

This competitive advantage is quickly being eroded, not just by access to information and better prices online, but by improvements in logistics. Driven by major organisations such as Amazon (recently announcing their Sunday delivery service in the US through the postal office), Google,

Returns are also still considered a significant barrier to online shopping. But studies show that not only are retailers offering in-store returns seeing greater online sales versus retailers who do not offer in-store returns, but this barrier is coming down with more retailers facilitating more convenient return options for shoppers.

This structural shift in logistics will mean retailers will need to focus much more on in-store customer experience, especially retailers of products that are perceived by shoppers as being as conveniently purchased online as in-store – such as electronics, homeware, necessity and basic fashion (t-shirts, underwear), household appliances.

This does not mean that the physical store isn’t important – on the contrary research shows that people still want to touch, feel, and inspect.

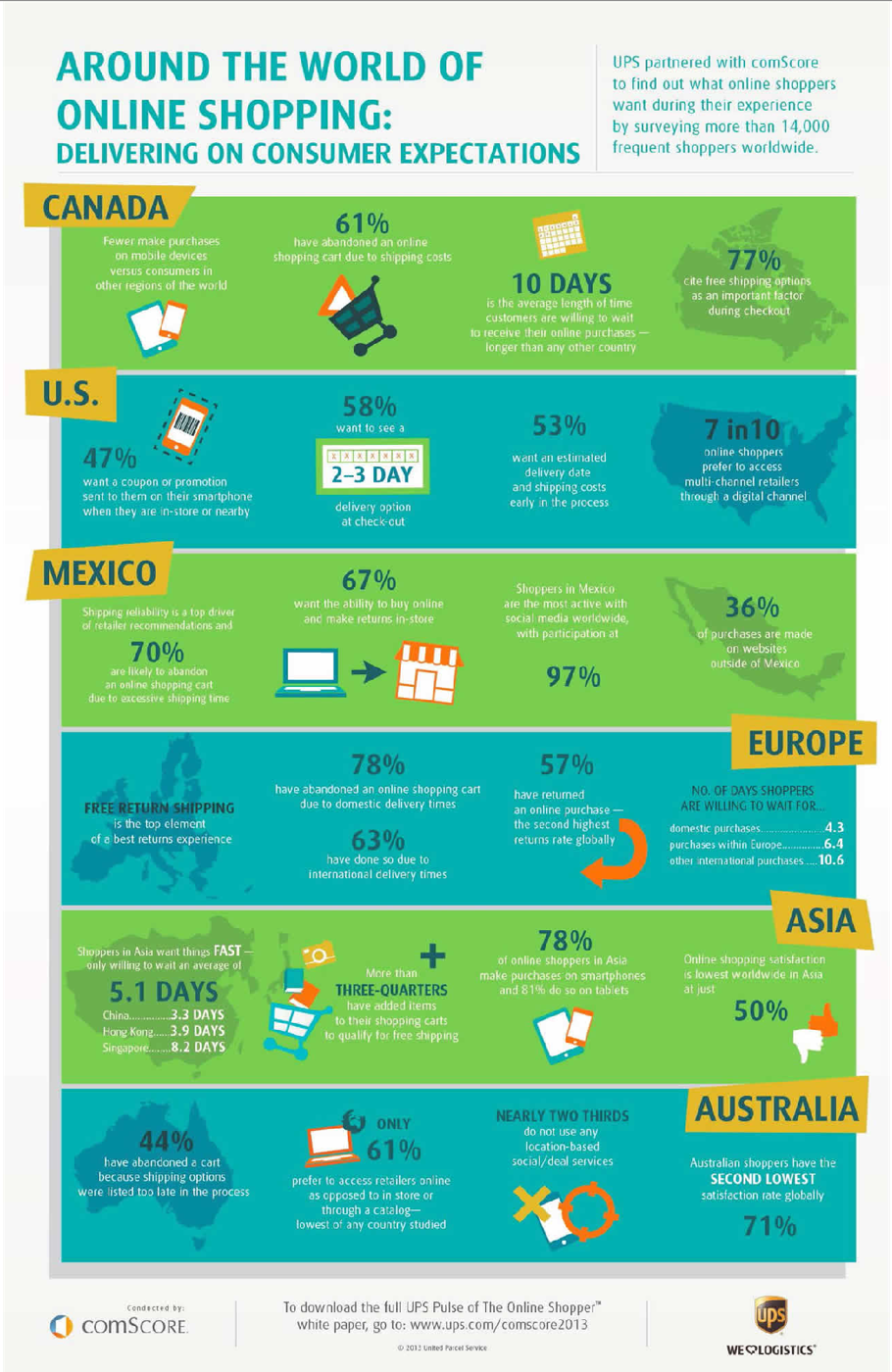

A recent study commissioned by UPS and conducted by ComScore revealed the behaviours and preferences of shoppers worldwide:

- Europeans have the second highest rate of returns of online purchases (57 per cent) and free returns shipping is the top element of a best returns experience.

- In Canada, consumers are willing to wait an average of 10 days to receive their online purchases and 69 per cent of consumers have added items to their carts to qualify for free shipping

- In the US, online shopping satisfaction is lower than 50 per cent for flexibility to choose delivery dates and re-route packages while only 44 per cent are satisfied with

flexibility to reroute packages - In Mexico, 52 per cent of consumers want the ability to complete a purchase in-store on their mobile device and 67 per cent of shoppers want the ability to buy online and make returns in-store

- In Asia and mainly China, only 50 per cent of online shoppers are satisfied (including only 38 per cent in Hong Kong) and 65 per cent have abandoned a cart due to shipping time not provided

- In Australia, shoppers have the second lowest online shopping satisfaction rate and 34% prefer to access their

favorite retailersin store versus via online channels

The future is not a world of dichotomy – of online and offline retail – but a world where there is no difference between online and offline. Ultimately it will simply be commerce. In the future there may still be

RECOMMENDATIONS FOR OPERATING IN AN OMNI- CONNECTED WORLD.

1. Managerial mindset:

Digital is a facilitator, not a stand-alone resource. Over time ‘digital’ will be the way we do things. Actually, we have been doing digital for some time but we have known it as information technology.

Step back in time for a moment and imagine telling someone they would be using personal computers to type reports, keep accounting records, update their Rolodex, send telex messages, access their bank records, write and calculate complex financial equations. Most would have thought of personal computers as a stand-alone resource. Yet today no business operates without some form of IT.

Digital is the label mainly for the convergence of information, technology, and end-user delivery through consumer-centric interfaces.

Digital has become the buzzword because while IT was focused on process optimisation, digital is about communication optimisation.

Communication is engagement. Engagement is attention. And attention is what businesses strive for to garner from their potential audiences in order to tell them about a product or service in the hope those listening will convert and purchase… repeatedly. Digital optimises this process.

Coming to grasp with the potential of this communication optimisation is the ongoing challenge as well as a field for innovation, and an area for research.

And because it is about communication it not only affects the obvious business areas – marketing, communications, PR – it impacts all areas of a business.

And so it

With this understanding comes a real mindset challenge. The mindset needs to change as it did when people had to let go of paper ledgers and typewriters. It’s a mindset that thrives in start-up environments because being at the cutting edge of something, exploring the unknown, is a place filled with trial, error, failure and only those who can grasp and be comfortable in this environment will be able to make the most of digital, and learn from and adapt to the findings of errors and failures.

The notion of failing often but failing fast is a very real one in the digital age – one that challenges the core foundations of so many companies entrenched in the certainty of things and processes that have been in place for decades.

Failing to change a mindset leads to business failure in the ‘long’ term… a term that is decreasing in length at a greater rate than in the past as a result of emerging technologies and rapid behavioural change.

Famous examples now include businesses such as Blockbuster and Borders Books.

Mindset changes won’t limit themselves to embracing digital communication practices, but also to digital ownership a point investigated by my fellow Which-50 contributor Malcolm Alder recently.

The proposed solution is having a clear strategic business purpose, identifying digital needs and responsibilities, and actively manage alignment. And this should come from the most senior managers whose responsibility it is to make sure that it permeates throughout the business.

2. Omnichannel operations:

Once you have overcome and have started to change mindsets – which may take up to several years in some cases through the development of strategy and buy-in from all stakeholders – you’ll need to evaluate, adjust, and invest in omnichannel operations.

Companies like The Luxottica Group took two years to formulate their digital strategy, and are now embarked on an 18-month implementation. They have increased their investment in digital technology by 300 per cent which translates into millions of dollars They have hired extensively to create a digital marketing team, and have a senior vice-president with a dedicated team overseeing digital across the group and reporting to the leadership group.

Your IT department (internal or outsourced) should lead and facilitate this by working closely with all business units. They need to capture all the requirements of the business along with the overall business objectives, but also for each business unit.

Two of the most important elements to consider in this process are:

- Your business’ customers

- Your staff as end users of the systems

Too often IT departments think a system is fantastic in their ultra geeky world view, and then push it onto business users resulting in a negative user satisfaction rate. User interface and user experience (UX) is vital in the adoption and usage of any system by your staff. If it looks rubbish and is visually overloaded with features, then staff will dislike using the system. Having interfaces that progressively disclose features is the way to go when building powerful complex systems.

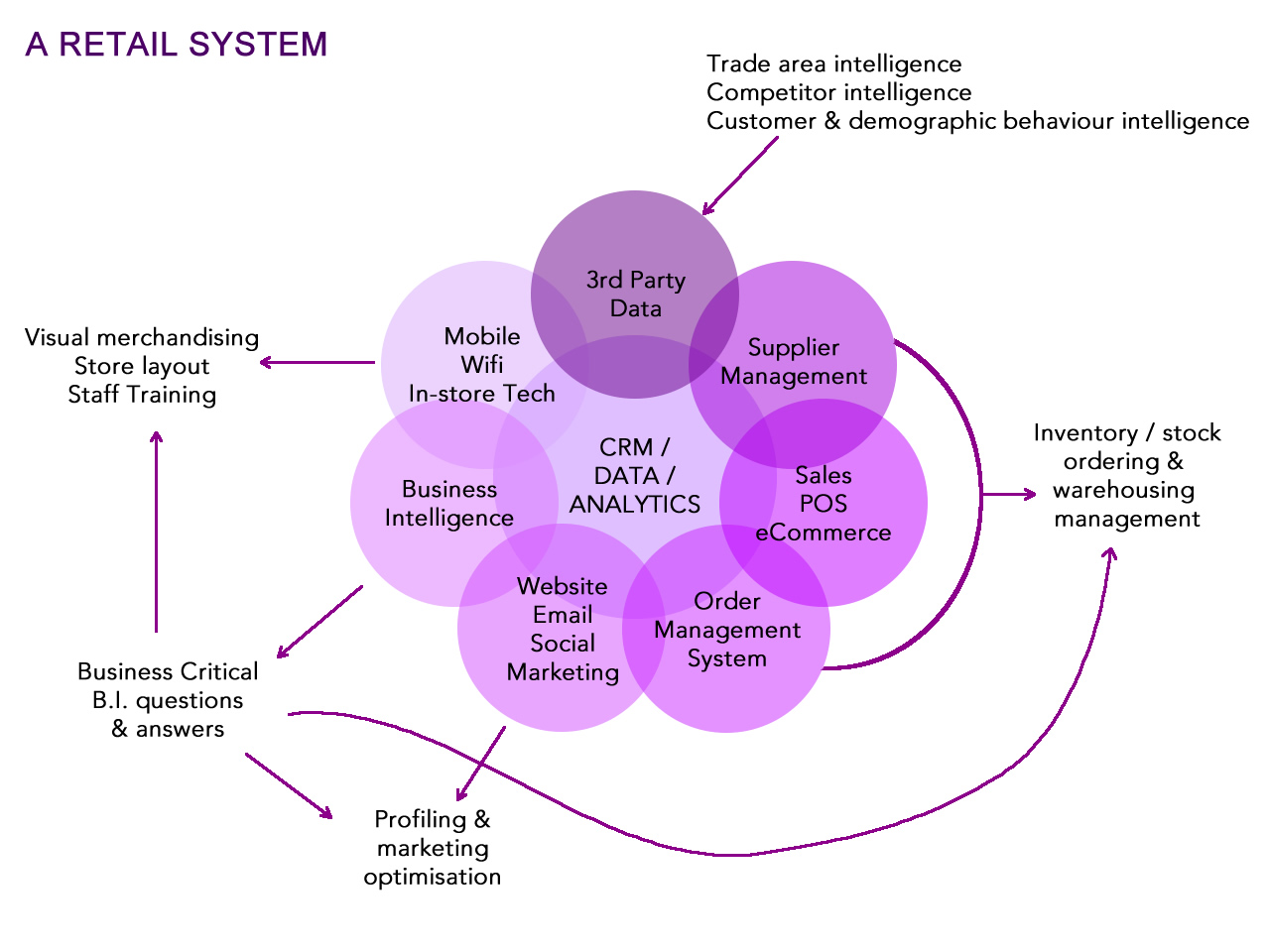

Your system should integrate your CRM, sales and POS, responsive Website (content management and analytics), order management and fulfillment system, inventory system, supplier management system, digital marketing system (email, social media, display advertising, search engine marketing), in-store technology including wifi and other tagging and tracking technology (such as TapStar’s new loyalty system or

Your omnichannel system should then be able to optimise your operations by answering numerous questions. You should be able to run business intelligence reports and gain valuable behavioural insights that will maximise your marketing efforts, delivering a higher conversion rate, repeat visitations and purchases, and ultimately increase your ROI:

- Who are my clients, really?

- Who are my most valuable clients, most valuable demographics, and most valuable customer profiles?

- What do my clients like best, what and when do they buy most?

- How do they use the store?

- How should we optimise visual merchandising?

- What is their

favorite delivery option? Is in in-store pick-up, home delivery, office delivery? - Should a particular store stock for local distribution of online orders?

- Should it become a showroom?

- Should it accept click and pick up orders?

- Should it stay open?

- What do clients think

of our staff? - Where should we open another store?

The benefits of interconnecting all systems will give you a big data approach to your business operations. For example, by using in-store technology including wifi and tagging all the products you sell you will be able to understand where shoppers are spending the most time in your store, how they are navigating the store, what they are looking at the most, and what they end-up purchasing.

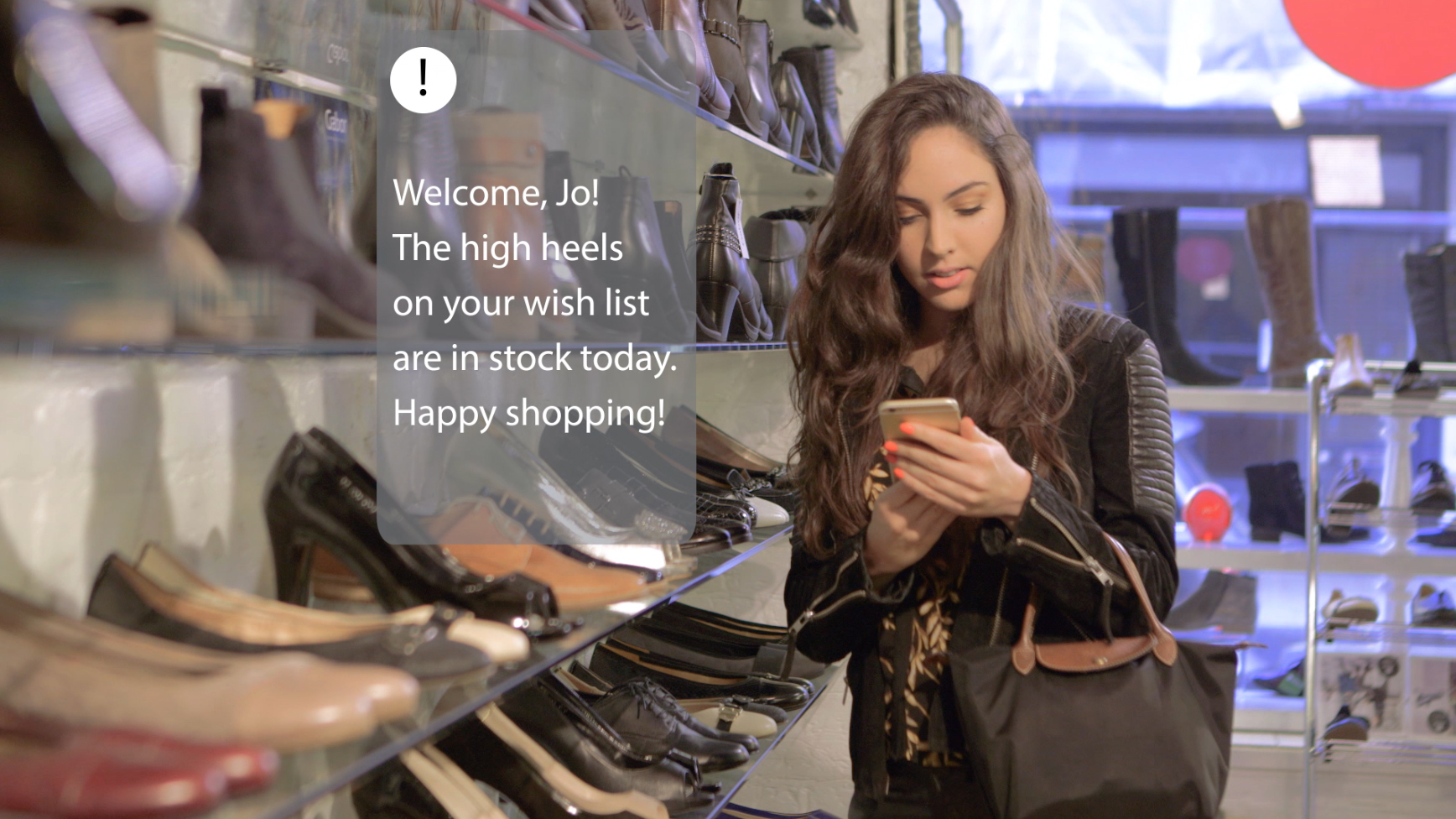

Technologies from providers like as TapStar, Vmob, Estimote or IBM can help you transform your store into a data-capturing hub and deliver smarter

Overlaying this with content such as social media engagement and real-time offers you’ll be able to increase your in-store conversion rate. Tracking mobile and online behaviour will give you a better understanding of who your customers really are – each particular profile – and which profile is most valuable. Adding third-party data from companies such as Experian and Quantium will enhance your understanding of where your customers live, what their online and offline habits are, and how they spend their money.

But beyond technology and digital insights, one of the most overlooked and powerful investments is your in-store staff – your front line sales team – those who interact with your customers and who represent your brand. The more knowledgeable they are the better they will be able to serve your customer. The more satisfied your customer feels about the service they receive the more likely they are to purchase and repeat purchase from your store.

SO WHAT WOULD YOUR RETAIL BUSINESS LOOK LIKE?

It would have an IT system in the cloud- not because that’s a buzz word but because it will be more cost effective long term while allowing for much greater flexibility to access services and data going forward – that integrated all- business-units system in a complex database and CRM solution. This database would collect all data created by all business units (leasing, supplier management, inventory, order

The website would track online behaviour (visitations, pages viewed, repeat visitation, time spent, visit navigation, conversion, shopping cart abandonment, content viewed and clicked), along with time, location, history of each visitor, preferences, demographics.

It would offer an easy

Allowing shoppers to either pick up their order in store, have it delivered in a few hours (express), or delivered in a couple of days (rapid), delivered in a week (slow), or delivered to a locker located on their commuting route for example (Australia Post’s locker network), or even pick-up from warehouse. Such options will be invaluable in the future success of

Mobile applications are another essential ingredient that includes:

- Smartphone apps – this application would not try to be everything to everyone but instead would surface the relevant content based on the user’s profile (history, preferences, demographics), location, and situation. Analysing those three elements (profile, location, situation) the applications would dynamically surface the most relevant content for the individual user at that particular place at that particular time. This application would focus on basic information and the ability to review and research products (including prices), navigate to and inside the store, and receive in-store recommendations including offers triggered by the user’s behaviour.

- Tablets – this application would be purely focused on browsing, pricing, comparing, recommending, and purchasing products and or services. It would be a glossy magazine type of application, rich with content. Like all other digital technology, it would track and store user behaviour data.

The website would track online behaviour (visitations, pages viewed, repeat visitation, time spent, visit navigation, conversion, shopping cart abandonment, content viewed and clicked), along with time, location, history of each visitor, preferences, demographics.

It would offer an easy

Allowing shoppers to either pick up their order in store, have it delivered in a few hours (express), or delivered in a couple of days (rapid), delivered in a week (slow), or delivered to a locker located on their commuting route for example (Australia Post’s locker network), or even pick-up from warehouse. Such options will be invaluable in the future success of

As showrooms, your stores would stock every item you sell in all the possible options, and technology (such as iPad, NFC/

Most importantly both your in-store staff and call centre staff would be highly trained about every product and service you sell, and go above the expectation of shoppers to help them find what they are looking for, even price comparing to the local market and matching the lower price found (as happened to me at an Apple store recently) – making for a pleasurable customer experience and increasing the chances of loyalty and repeat purchase.

When it comes to marketing, focus your efforts on:

- Your website and applications dynamically presenting content, offers, and recommendations that the individual shopper would be interested in most.

- Using data analytics across all the customer information your omnichannel system gathers, focus on social media in your particular geographical areas (mainly through Facebook) with a well crafted content strategy around an established conversational calendar (including crowdsourced content, competitions), digital

cross promotion , SEO, SEM, some digital display advertising, online video advertising.

- Using all the customer data available, look at branded content initiatives that are most relevant to your most valuable shopper profiles.

- And very carefully choose some traditional advertising across print, outdoor, radio that targets your most valuable shopper profile.

“The future of retail is in the hands of retailers.”

The future of retail is in the hands of retailers. Those who adopt the right mindset, the right level of investment in an omnichannel approach to their business, in technology, in human resources and in staff training will succeed. This is due to significant market forces driven by major changes in consumer behaviours powered by technological innovations and shifting control to a consumer population now exposed to a vast amount of choice never seen before at each step of the purchasing path.

This means consumers are now able to choose how, where, when, and at what price they are willing to purchase a product or service.

Remembering that convenience and customer service are key, the simplicity of customer-facing operations (website, mobile, in-store layout and visual merchandising) will present the convenience sought, while training staff to have a deep knowledge of products and services will deliver the expected customer service, leading to loyalty and repeat purchases.